Some Known Details About Thomas Insurance Advisors

Wiki Article

Thomas Insurance Advisors - An Overview

Table of ContentsEverything about Thomas Insurance AdvisorsThomas Insurance Advisors - TruthsThe Single Strategy To Use For Thomas Insurance AdvisorsSome Known Incorrect Statements About Thomas Insurance Advisors Everything about Thomas Insurance Advisors

The cash money worth element makes entire life more intricate than term life as a result of fees, taxes, interest, as well as other specifications. Universal life insurance policy is an adaptable permanent life insurance policy policy that lets you reduce or boost how much you pay toward your regular monthly or annual premiums in time. If you reduce just how much you spend on costs, the difference is taken out from your plan's cash value.An universal plan can be a lot more expensive and difficult than a typical entire life policy, particularly as you age and your costs enhance (https://thomas-insurance-advisors.jimdosite.com/). Best for: High income earners that are attempting to build a nest egg without going into a greater earnings brace. Just how it works: Universal life insurance coverage permits you to readjust your costs and also death benefit depending on your demands.

:max_bytes(150000):strip_icc()/how-does-insurance-sector-work.asp-FINAL-1ccff64db9f84b479921c47c008b08c6.png)

Facts About Thomas Insurance Advisors Revealed

Pro: Gains possible variable plans may make even more interest than typical whole life. Disadvantage: Investment danger capacity for losing cash if the funds you selected underperform. Last expenditure insurance policy, likewise referred to as funeral insurance coverage, is a kind of life insurance made to pay a small death benefit to your household to assist cover end-of-life expenditures.

Since of its high prices and lower insurance coverage quantities, final cost insurance coverage is typically not as great a worth as term life insurance policy. How it works: Unlike many conventional policies that call for a clinical exam, you only require to address a couple of inquiries to qualify for last cost insurance policy.

Thomas Insurance Advisors - An Overview

Pro: Assured protection very easy accessibility to a small advantage to cover end-of-life costs, consisting of medical bills, interment or cremation solutions, and also coffins or containers. Disadvantage: Price costly costs for lower protection amounts. The most effective way to select the policy that's best for you is to speak with a monetary consultant and also collaborate with an independent broker to discover the right policy for your certain needs.Term life insurance policy plans are generally the very best service for people that require budget friendly life insurance coverage for a certain duration in their life (https://www.magcloud.com/user/jstinsurance1). If your goal is to offer a safeguard for your family members if they had to live without your earnings or payments to the family, term life is likely a great suitable for you.

If you're currently optimizing payments to typical tax-advantaged accounts like a 401(k) as well as Roth IRA as well as desire one more investment car, irreversible life insurance might function for you. Final expense insurance coverage can be a choice for individuals that may not be able to get insured otherwise due to the fact that of age or severe health and wellness conditions, or elderly customers that don't wish to burden their families with funeral prices."The appropriate kind of life insurance for every person is totally based on their private situation," says Patrick Hanzel, a licensed financial coordinator as well as progressed planning supervisor at Policygenius.

Fascination About Thomas Insurance Advisors

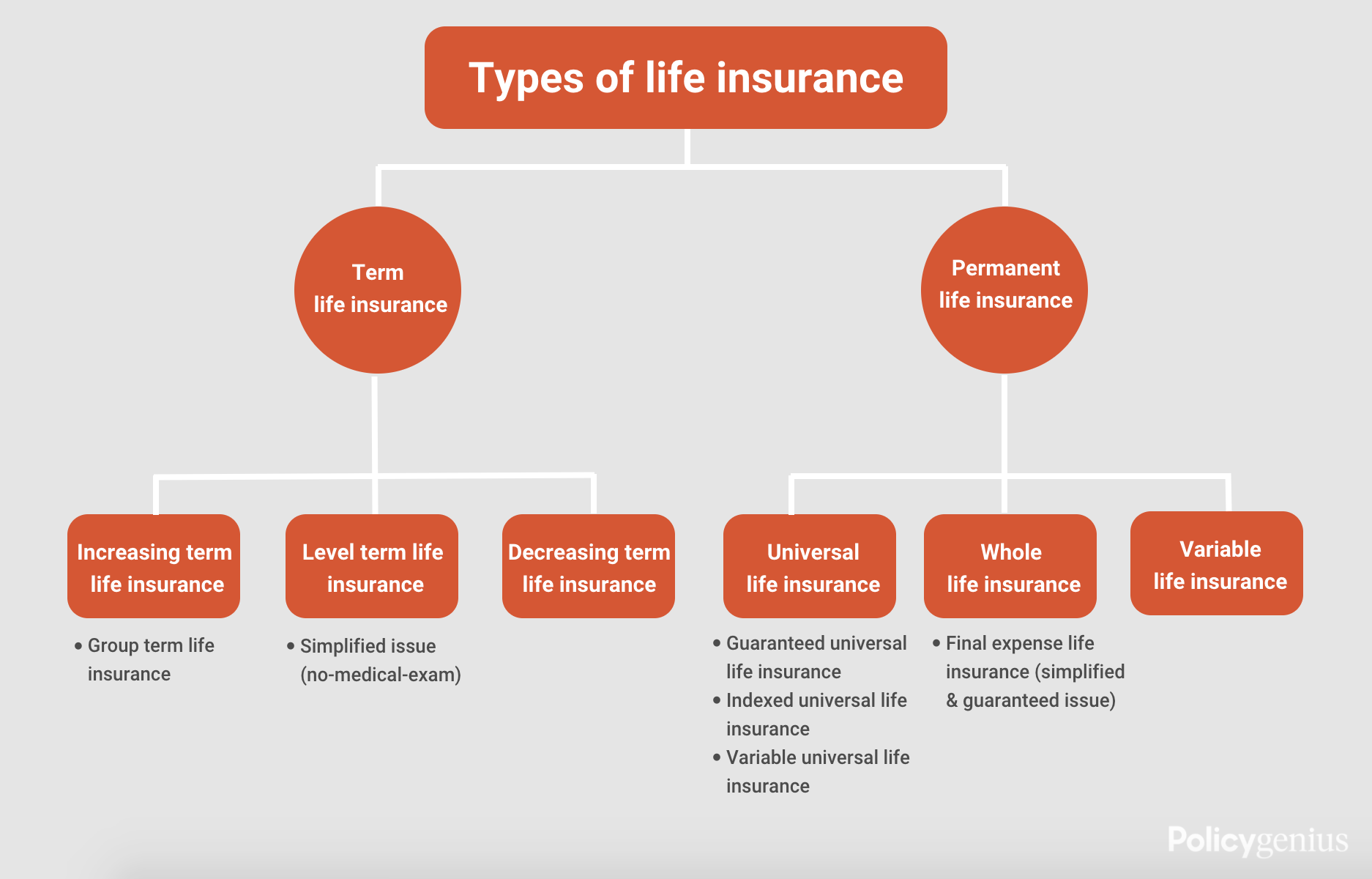

A lot of these life insurance policy alternatives are subtypes of those included above, implied to offer a specific function, or they are specified by how their application process also called underwriting jobs - https://trello.com/u/jstinsurance1. By kind of protection, By kind of underwriting Group life insurance policy, likewise called group term life insurance policy, is one life insurance policy contract that covers a group of individuals.Team term life insurance coverage is typically funded by the policyholder (e. g., your employer), so you pay little or none of the policy's costs. You obtain protection approximately a restriction, normally $50,000 or one to 2 times your yearly salary. Group life insurance policy is economical and also very easy to receive, however it hardly ever supplies the level of protection you may need and also you'll possibly lose insurance coverage if you leave your job.

Best for: Any individual that's offered group life insurance by their employer. Pro: Convenience team policies offer guaranteed insurance coverage at little or no cost to staff members.

The Ultimate Guide To Thomas Insurance Advisors

With an MPI plan, the beneficiary is the mortgage firm or lending institution, rather than your family, and the fatality advantage reduces gradually as you make mortgage settlements, similar to a decreasing term life insurance policy policy. Purchasing a basic term policy instead is a far better option. Best for: Anyone with mortgage obligations who's not eligible for standard life insurance policy.Disadvantage: Limited protection it just secures home loan payments. Credit life insurance is a type of life insurance policy plan that pays to a lending institution if you die prior to a loan is repaid rather than paying to your recipients. The plan is tied to a single financial debt, such as a home mortgage or organization loan.

You're ensured authorization and also, as you pay down your lending, the death advantage of your policy decreases. Automobile Insurance in Toccoa, GA. If you die while the policy is in pressure, your insurance service provider Read Full Article pays the survivor benefit to your lending institution. Home mortgage defense insurance coverage (MPI) is one of the most common kinds of debt life insurance policy.

Report this wiki page